August 9th, 2022

TOPIC: Rebate Program

This is one of many guides that teaches you various tax-saving opportunities available.

If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops!

Today you will be learning about the special rebate program for Pennsylvanians.

You will find out what it is, who can qualify for it, and much more. Keep reading to learn about this rebate!

What Is This Rebate Program?

Governor Tom Wolf announced that older Pennsylvanians and people who qualified for a rent or property taxes rebate in 2021 would get another rebate this year.

It is a one-time bonus rebate to help vulnerable Pennsylvanians during these times of hardship.

It was recently signed into law when Governor Wolf signed Act 54 of 2022.

Who Can Qualify For This Rebate Program?

This rebate program is for Pennsylvanians who are:

- 65 and older

- Widow and widowers age 50 and older

- People with disabilities age 18 and older

- You could not work because of your medically determined physical or mental disability. That disability is expected to last indefinitely.

It does not matter if you own a home or rent an apartment; you can still receive money from this rebate.

However, the amount of money you will receive will vary depending on if you own a home or rent.

Note: If you applied for social security disability benefits and the social security administration did not rule in your favor, you’re not eligible for this rebate.

How Much Can I Receive?

Assuming you received a rebate last year, this bonus rebate will equal 70% of your original rebate amount.

Hence, the maximum that you can receive is normally $650.

That number then decreases depending on your annual salary and renting or owning a home.

Note: Any vulnerable homeowner who makes over $35,000 per year will not be eligible for this rebate.

Likewise, any vulnerable renter who makes over $15,000 per year will not be eligible for this rebate.

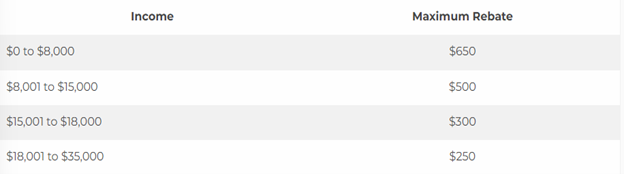

Here is a chart showing the income phaseouts for people who own a home.

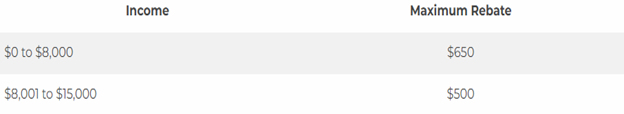

Here is a chart showing the income phaseouts for renters.

While the maximum standard rebate is $650, supplemental rebates for qualifying homeowners can boost the rebate to $975.

People who normally qualify for that boost live in parts of the state with high tax burdens. So you would live in places like Philadelphia, Scranton, Pittsburgh, etc.

How Can I Apply For The Rebate?

If you already received the rebate last year, you don’t need to take any additional steps to get the bonus rebate.

The department of revenue will take care of everything on the back end. You will receive the bonus money through the same method as before (direct deposit or check)

However, if you have not applied and received the original rebate yet. You can do so by doing the following:

- Go to www.revenue.pa.gov

- Call 1-888-222-9190

- You can also mail this Rebate Claim Form

Note: Spouses, personal representatives, or estates may also file rebate claims on behalf of the vulnerable person.

Once you have applied for the rebate, you can check the status of the rebate by using the myPATH portal.

You can also call 1-888-PA-TAXES if you don’t want to use the portal.

When Is The Deadline To Claim Rebate?

The department had the original deadline of June 30th, 2022.

However, they still have some funds available and are extending the deadline to December 31st, 2022.

When Will These Bonus Rebates Be Given Out?

The distribution of bonus rebates started to occur around mid-August of 2022.

Anyone who has already received last year’s rebate should receive their rebate within the next few weeks (if they haven’t gotten it already).

Anyone with a rebate application that is still being processed or hasn’t submitted their application yet will receive the original rebate and bonus combined via check or direct deposit.

Want To Read More Educational Content Like This?

We created a blog that shows you the top 11 states that are tax-friendly to middle-class families and retirees.

If you’re considering moving to a different state or just love traveling, this blog is for you!

Click the link below to start reading now.