Let Our Firm Solidify and Expand Your Investments!

Over the years, we have had many clients come to us and thank us for bringing forth a concept they thought they would never reach: investing whether you are an investor or want to become one. KDA is the place for you. We work with clients in all 50 states and have personal investments and deals that we have won and learned from.

Our firm can guide you into new territory and teach you the language of investments, and generational wealth. If you are already an investor, we can guarantee to save you money and find ways through our tax strategy that can help you invest more and more.

We will also partner up with you in making sure we understand and acknowledge all your future goals and NOT just the present ones. Investing is a long term decision, and unlike other firms, we want to hear your concerns, questions, and future goals. We take everything into account and create a strategy road map that you can understand and follow.

Let us guide you, teach you, and be that listening, aiding ear that you have been searching for- we look forward to it!

From Our Blog

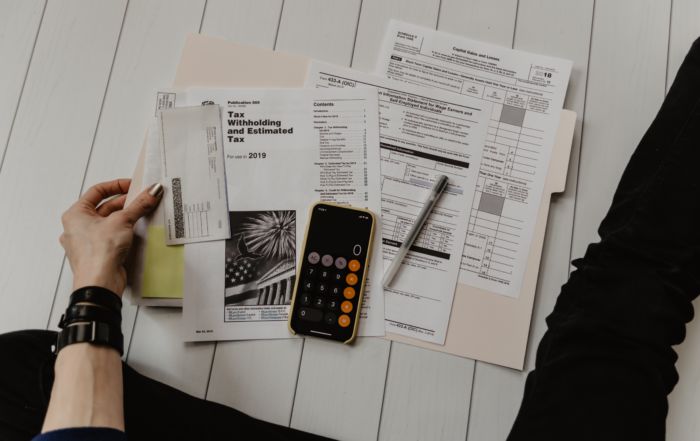

Six Must-Know Tips To Get a Fast Tax Refund In 2023!

01/23/23 Topic: How To Your Tax Refund Fast Tax season starts today, and many Americans around the nation are excited to receive their refunds. This blog post will list six things you do to ensure you receive your tax refund in the least amount of time possible. E-File Whenever Possible The IRS is currently facing a tax refund backlog. They still have millions of tax returns [...]

How To Create An Effective Budget In 2023

01/06/2023 TOPIC: Finance This is one of many guides that teaches you about finance to help you better manage and save your money. If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! In this blog, we are showing you how you can create a budget. If you are considering [...]

The Pros & Cons Of Starting An LLC In 2023!

01/06/23 TOPIC: Business Growth In this blog, we are listing the pros and cons of opening an LLC. If you're someone who is debating on opening an LLC, this is a blog you don't want to miss! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops What [...]

Tax Preparer vs. Tax Strategists: Which Will Save You The Most Money In 2023?

December 29, 2022 TOPIC: Taxes Tax season is coming very soon, and you're probably wondering how to maximize your tax savings this upcoming season. In this blog, you will learn the difference between a tax preparer and a tax strategist and determine which professional can save you the most money on taxes. What Is a Tax Preparer? A tax preparer prepares, calculates, and files income taxes on [...]

IRS’S New Tax Law! A $600 Headache For Millions Of Americans?

December 9th, 2022 TOPIC: IRS New Tax Law This guide will educate you on the IRS's new $600 reporting requirement. If you use third-party payment apps like PayPal or Venmo, keep reading! If you like blogs like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! What Is This New $600 Law? This new [...]

Detailed Beginner’s Guide: How To File Taxes 101

December 1st, 2022 TOPIC: How To File Taxes This guide will educate you on how to file taxes as a beginner. If you or someone you know has never filed taxes before and want to learn how this blog is for you! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a [...]