Let Our Firm Help Your Start-Up Business Succeed

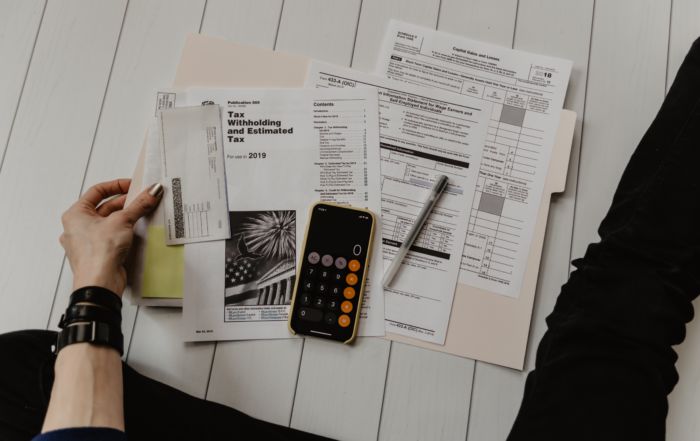

For many entrepreneurs who start their own business, it often becomes clear that managing their company’s finances and taxes can be a full-time endeavor in and of itself—not to mention keeping up with the impact that being a business owner can have on their personal finances. That’s where our firm can help relieve the burden.

If you’re just starting a new business, our firm can guide you through the process of entity selection, provide valuable tax planning advice, and help you optimize your accounting structure. And, when your business grows to the point that you need professional back office and tax preparation support, look no further than our team of financial professionals to deliver comprehensive, affordable solutions that allow you to focus on growing your business—not day-to-day financial management.

Our firm will also partner with you throughout the year to ensure that your new business is in compliance with the latest tax codes, that your tax payments remain on track, and that your tax burden is reduced whenever possible. We’ll also ensure that your personal finances are on track and that you taking full advantage of any potential tax savings related to your unique situation.

Let us be your trusted financial advisor—with you every step of the way as your business and personal financial needs evolve. Contact our firm today.

From Our Blog

Six Must-Know Tips To Get a Fast Tax Refund In 2023!

01/23/23 Topic: How To Your Tax Refund Fast Tax season starts today, and many Americans around the nation are excited to receive their refunds. This blog post will list six things you do to ensure you receive your tax refund in the least amount of time possible. E-File Whenever Possible The IRS is currently facing a tax refund backlog. They still have millions of tax returns [...]

How To Create An Effective Budget In 2023

01/06/2023 TOPIC: Finance This is one of many guides that teaches you about finance to help you better manage and save your money. If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! In this blog, we are showing you how you can create a budget. If you are considering [...]

The Pros & Cons Of Starting An LLC In 2023!

01/06/23 TOPIC: Business Growth In this blog, we are listing the pros and cons of opening an LLC. If you're someone who is debating on opening an LLC, this is a blog you don't want to miss! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops What [...]

Tax Preparer vs. Tax Strategists: Which Will Save You The Most Money In 2023?

December 29, 2022 TOPIC: Taxes Tax season is coming very soon, and you're probably wondering how to maximize your tax savings this upcoming season. In this blog, you will learn the difference between a tax preparer and a tax strategist and determine which professional can save you the most money on taxes. What Is a Tax Preparer? A tax preparer prepares, calculates, and files income taxes on [...]

IRS’S New Tax Law! A $600 Headache For Millions Of Americans?

December 9th, 2022 TOPIC: IRS New Tax Law This guide will educate you on the IRS's new $600 reporting requirement. If you use third-party payment apps like PayPal or Venmo, keep reading! If you like blogs like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! What Is This New $600 Law? This new [...]

Detailed Beginner’s Guide: How To File Taxes 101

December 1st, 2022 TOPIC: How To File Taxes This guide will educate you on how to file taxes as a beginner. If you or someone you know has never filed taxes before and want to learn how this blog is for you! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a [...]