Business Foundation Service

Most entrepreneurs dream of running a successful business. In most cases, the plan is usually to come up with an idea, start a business from the idea, get customers for your business, scale up quickly and make a lot of money.

But it doesn’t happen that easily in real life. Running a successful business is no easy task. It requires a lot of effort, without which, a business is likely to fail. However, with a well thought out plan, nothing is impossible. A well-executed plan will set your business up for success by providing you with a road map that you will follow as you build your business.

For long-term business success, however, you need to lay a strong foundation for your business that will hold it together when things get tough. The stats on businesses failing in their formative years are quite worrying and you could be headed down this path if your business has not been set up on the right foundation.

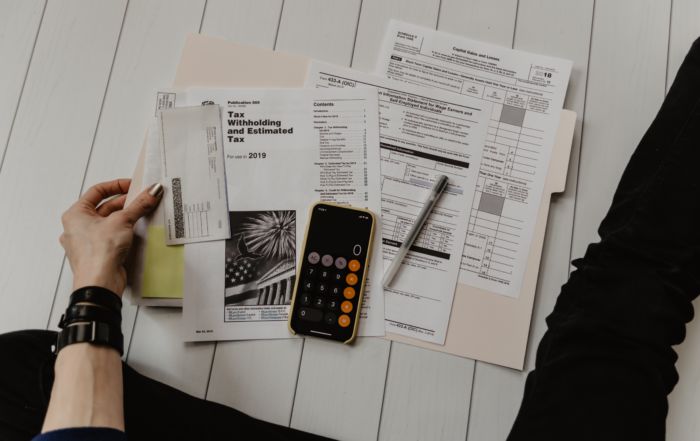

You need proper accounting solutions to give your business a good foundation for future success and our Business Foundation Service will set you up for life.

We created this service to help small businesses manage the challenges of getting a business up and running. This service is also ideal for business owners who are considering a change of direction as it entails tips on how to handle the complexities of launching a new venture.

Your Dedicated Business Partner

How you handle your finances will determine whether your business will succeed or not. We have been in the financial industry for some time now and we have helped business soar by providing them with dedicated financial services. We guide and coach businesses owners on how to handle their finances so as to guarantee business success. The IRS is not your friend and they will pounce on you when they realize that your taxes are not in order. Our Business Foundation Service will provide you with financial education on how to deal with the IRS so as to avoid a visit by the taxman.

The focus of our Business Foundation Service is education as we believe it is the only way to prepare business owners for the hurdles that lay ahead. Running a business is not easy and no business owner should do it alone. By partnering with the right organizations like Karla Dennis And Associates, Inc.™, you set your business up for success and longevity. We have the experience to guide business owners as they lay the right foundations for their businesses. As part of our Business Foundation Service package, we will ensure that;

Your business is operating under the right structure.

Your accounting system is set up properly for effective business management.

You learn the right bookkeeping guidelines so as to make it easy for you to capture all your incomes, expenses, and to reduce your taxes.

You follow the right accounting guidelines so as to avoid getting audited by the IRS.

START TODAY

Sign up for our Business Foundation Service and let us set up your business for long-term success by laying the right foundation.

Our Business Foundation Services Packages Includes:

Guaranteed Success with Our Business Foundation Service

Our Business Foundation Service is designed to make sure that your business doesn’t become part of a statistic. With most businesses failing shortly after being launched because of poor planning, our Business Foundation Service sets up your business for success by giving it the foundation it needs to weather storms when it is still young.

When you choose us as a partner for your business, you can relax in the knowledge that you are getting business advice from a competent tax and accounting firm. You are also sure that you will get the best accounting system that will provide you with the right data for your management process.

Our tax and accounting experts are friendly and willing to assist you. Contact us today and together let us build a strong foundation for your business that will guarantee you long-term success.

From Our Blog

Six Must-Know Tips To Get a Fast Tax Refund In 2023!

01/23/23 Topic: How To Your Tax Refund Fast Tax season starts today, and many Americans around the nation are excited to receive their refunds. This blog post will list six things you do to ensure you receive your tax refund in the least amount of time possible. E-File Whenever Possible The IRS is currently facing a tax refund backlog. They still have millions of tax returns [...]

How To Create An Effective Budget In 2023

01/06/2023 TOPIC: Finance This is one of many guides that teaches you about finance to help you better manage and save your money. If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! In this blog, we are showing you how you can create a budget. If you are considering [...]

The Pros & Cons Of Starting An LLC In 2023!

01/06/23 TOPIC: Business Growth In this blog, we are listing the pros and cons of opening an LLC. If you're someone who is debating on opening an LLC, this is a blog you don't want to miss! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops What [...]

Tax Preparer vs. Tax Strategists: Which Will Save You The Most Money In 2023?

December 29, 2022 TOPIC: Taxes Tax season is coming very soon, and you're probably wondering how to maximize your tax savings this upcoming season. In this blog, you will learn the difference between a tax preparer and a tax strategist and determine which professional can save you the most money on taxes. What Is a Tax Preparer? A tax preparer prepares, calculates, and files income taxes on [...]

IRS’S New Tax Law! A $600 Headache For Millions Of Americans?

December 9th, 2022 TOPIC: IRS New Tax Law This guide will educate you on the IRS's new $600 reporting requirement. If you use third-party payment apps like PayPal or Venmo, keep reading! If you like blogs like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops! What Is This New $600 Law? This new [...]

Detailed Beginner’s Guide: How To File Taxes 101

December 1st, 2022 TOPIC: How To File Taxes This guide will educate you on how to file taxes as a beginner. If you or someone you know has never filed taxes before and want to learn how this blog is for you! If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a [...]