Table of Contents

9 August 2022

TOPIC: Earned Income Credit

This is one of many guides that teaches you various tax-saving opportunities available.

If you like guides like this, feel free to follow us on social media and subscribe to our email list to get updates on when a new blog drops!

Today you will be learning about Earned Income Credit. You will find out what it is, who can qualify for it, and much more. Keep reading to learn about this tax credit!

What Is Earned Income Credit?

Earned income credit is a tax credit designed to lower the tax burden of hard-working families and individuals.

It was enacted in 1975 to benefit working-class families with earned income.

It was made to promote and support good work ethics and fight poverty. The U.S. government likes to support those who are working and contributing to society.

The earned income tax credit (also known as EITC) is known for two things.

- To lower the tax liability for hard-working families and individuals

- To increase the tax refund from the government.

Depending on your income, you can qualify for a tax credit that can boost your refund from the government.

If you’re low or middle class, you might be eligible to receive this credit. Exactly how much credit you get depends on your income and family size.

Note: It is important to note that even single workers without a child might qualify for the credit.

Who Can Qualify For it?

The government has rules to ensure EITC only helps the people who need it most and are working to provide for themselves.

This credit is not for people who are wealthy or are non-working citizens.

To qualify for this tax credit:

- You must have earned income from a job

- You can’t make more than a certain amount of money (more on this below)

- You must show proof of earned income

- Have an investment income of $10,300 or less

- Have a valid Social Security number

- Claim a certain filing status (i.e., head of household, single, married filing jointly)

- Be a U.S. citizen or a resident alien all year

Note: You do not qualify if you’re married but filing separately.

EITC Income Limits

There is a limit on how much money you can make in order to qualify for this credit.

The IRS calls it AGI (Adjusted Gross Income). AGI is your gross income (before taxes) minus any adjustments.

Adjustments you might make to your gross income include student loan payments, business expenses, and other expenses.

You can find your AGI on line 11, page 2 of your form 1040.

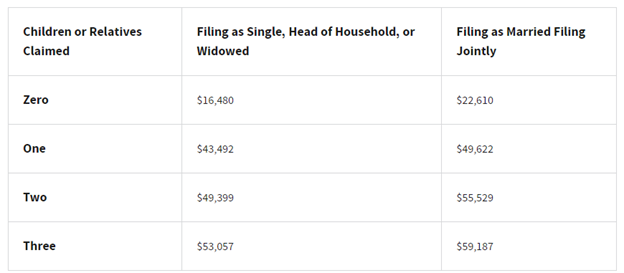

The chart below shows who can qualify for this credit based on their adjusted gross income, filing status, and how many children they have to claim.

As you can see from this table, the IRS has strict rules on who can qualify for this credit.

For example:

If you’re single, have no kids, and make $40,000 annually, you would not qualify for this credit.

However, if you’re single, have no kids, and make $15,000 annually, you would be eligible for this tax credit.

How To Claim Earned Income Credit?

Assuming that you qualify for the credit, the next step to claim it is filing a federal tax return.

You must file form 1040 or 1040 SR if you’re a senior.

If you’re filling out the form by yourself, it is recommended that you file it electronically.

When you e-file, you will be asked questions to ensure you get the credit you deserve.

How Much Can I Save With Earned Income Credit?

As mentioned before, how much credit you get depends on your income and family size.

Here is the maximum credit you can claim for the next tax season (2022 tax filing season).

- No qualifying children: $560

- One qualifying child: $3,733

- Two qualifying children: $6,164

- Three or more qualifying children: $6,935

Is the tax credit worth it?

This is one of those tax credits that are worth claiming. Tax credits reduce how much you pay in taxes dollar for dollar.

Depending on how much you owe in taxes, this credit alone could cover over half or more of your tax bill.

That means you would owe nothing in taxes.

Instead, you could use your money for important things like providing for yourself or your family.

Want to learn more about how tax credits work?

We created a blog showing you the difference between tax credits and deductions.

Click Here to start learning more about tax credits today!

To Summarize

Earned income tax credit is a credit designed to help hard-working Americans of the middle to low class.

This tax credit could lower your tax bill or give you a bigger tax refund next tax season.

In the end, if you qualify for this credit, you should claim it. It is one of the ways the government is trying to support you and your family.