The flow of money in a company is bewildering. Companies make a lot of purchases, pay a lot of expenses, owe money to several entities, acquire sales, and collect money from its clients.

[dropcap]T[/dropcap]hese transactions must be tracked so that the company would be able to determine its financial standing. The responsibility of documenting these important transactions goes to the bookkeeper.

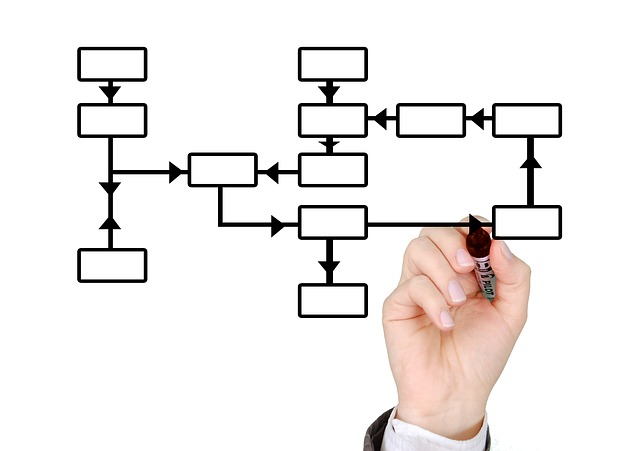

Typically, a business follows a standard bookkeeping process. Normally, during the course of a business transaction, a document is produced. Examples of these documents are invoices or receipts, which are issued for sales and purchases. Deposit slips are produced when the company deposits money to their bank accounts. Checks are used to pay certain accounts.

The first part of the bookkeeping process involves recording the details of these documents into multi-column journals called daybooks. Each journal corresponds to a specific transaction. For example, credit sales are recorded in a sales journal, cash payments are recorded in a cash payments journal. The transactions can either be recorded singly for single-entry bookkeeping or twice for double-entry bookkeeping. The columns in the journal correspond to an account.

After a period of time, usually a month, the columns in each journal are added to give a summed total. This is the second part of the bookkeeping process. The summaries are then posted to their respective accounts in the ledger, or book of accounts. When posting is complete, the accounts undergo another process to arrive at a balance.

After balancing, a working document called unadjusted trial balance is created. This part of the bookkeeping process allows the bookkeeper to quickly check of the posting process was done accurately. If an account has a debit balance, the balance amount is posted in the debit column of the trial balance. If an account has a credit balance, the amount is copied into the credit column. The two columns are then totaled. The two totals must be the same. If the two totals are not the same, an error has been made in either the journals or the posting process. The error must be located and corrected. The totals of the debit and credit column must be recalculated before proceeding.

Assuming there are no errors, the accountant can proceed to the next bookkeeping process. She produces some adjustment and changes of the balance amounts. This produces a listing called the adjusted trial balance. The altered accounts in this list and their corresponding debit or credit balances are used to make the companyís financial statement.

The final step in the bookkeeping process involves preparing the financial statement itself. The statement may include the income statement, profit and loss statements, the balance sheet, the cash flow statement and the statement of retained earnings.

Leave A Comment

You must be logged in to post a comment.