EMPOWER YOUR LIFE

ELEVATE YOUR WEALTH

EMPOWER YOUR LIFE

ELEVATE YOUR WEALTH

Featured In

Most people think saving money on taxes is all about having a good accountant, fancy tax software, and up-to-date books.

But that’s only part of the picture.

Saving money on taxes is a lifestyle. A mindset.

Karla Dennis has helped thousands of business owners keep more of their hard-earned money.

And you know what she’s found?

The biggest thing stopping them… is themselves.

They assume tax breaks are for “bigger” businesses.

They’re scared of messing up.

They worry the IRS will come knocking.

So what happens?

They overpay on taxes—year after year.

But here’s the truth:

The tax code was written for business owners like YOU.

Karla believes in you.

And she’s here to help you reclaim your money, build wealth, and unlock your full potential.

Because when you understand taxes, you unlock health, wealth, love, and happiness

—at a level you’ve never experienced before.

It all starts with a choice.

The choice to educate yourself.

The choice to take control of your life.

Ready to stop overpaying and start keeping more of what you earn?

WHAT PEOPLE ARE SAYING

Lorem ipsum dolor sit!

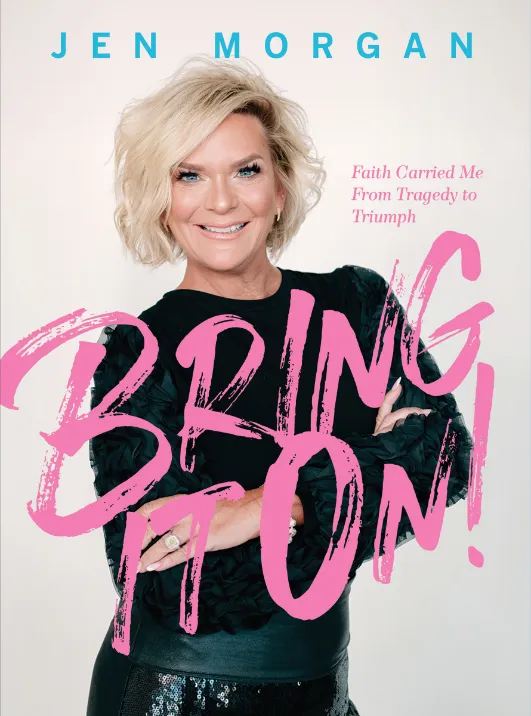

We believe progress leads to financial freedom. Meet the woman who has devoted 30 years of tax strategy expertise, Karla Dennis has helping everyday Americans keep more of their hard-earned money—ensuring they never leave Uncle Sam a tip.

Lorem ipsum dolor sit!

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium. Integer tincidunt. Cras dapibus. Vivamus elementum semper nisi. Aenean vulputate eleifend tellus.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu.

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo, rhoncus ut, imperdiet a, venenatis vitae, justo. Nullam dictum felis eu pede mollis pretium.

Jenny Lorem Ipsum

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem. Nulla consequat massa quis enim. Donec pede justo, fringilla vel, aliquet nec, vulputate eget, arcu. In enim justo.

- Aenean leo ligula, porttitor eu, consequat vitae, eleifend ac, enim. Aliquam lorem ante, dapibus in, viverra quis, feugiat a, tellus. Phasellus viverra nulla ut metus varius laoreet.

Curabitur ligula sapien!

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massaenean vulputate eleifend tellus. –